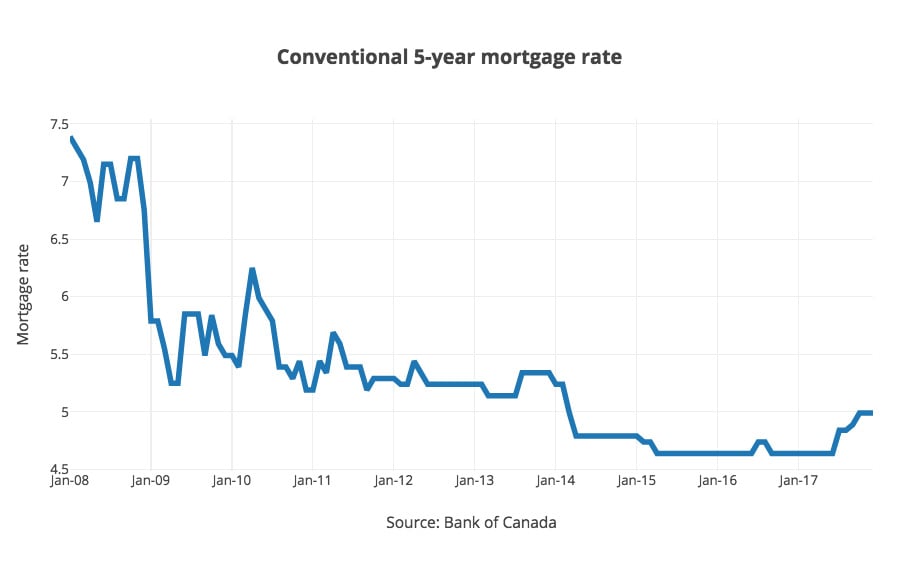

Have a look at this chart. It reveals the real cost of buying a house over thirty years. If you acquire a $300,000 home today, over thirty years, it could cost you almost $1 MILLION. In the end, you're not throwing your money away by renting however you will toss your cash away if you purchase a house without understanding what you're doing.

Inspect it out. If you're stressed over your individual financial resources, you can improve them without even leaving your couch. Inspect out my Ultimate Guide to Personal Financing for pointers you can execute TODAY. Just Stop it. Right now. This is effectively two misconceptions in one but they both boil down to one concept: People believe they can guarantee that they will earn money by investing in real estate. It makes sense. Women aren't purchasing great deals to begin with, so why would they put money into realty investing? According to an S&P Worldwide study carried out last year, just 26% of females in the U.S. purchase stocks and bonds. That suggests more than three-quarters of the country's females aren't taking part in the markets, let alone purchasing real estate.

And diversification might be especially important throughout the COVID-19 pandemic when volatility rules the stock market. "With real estate you do not have the same correlation to stocks," states Carol Fabbri, a CFP and Principal at Fair Advisors. "It's an excellent method of diversifying. You desire to diversify as much as you can to lower volatility in your portfolio." Whether you're trying to find a hands-on approach or want passive exposure, there are simple ways to purchase real estate.

REITs are publicly traded companies that invest in income-producing property or purchase domestic and commercial home loans. They trade like stocks timeshare relief consultants however are required by law to distribute 90% of their profits to investors via dividend payments. That has made REITs popular with income-seeking investors. You can acquire REITs via shared funds or exchange-traded funds.

Many REITs zero in on one location of the property market, while others have a number of various property types in their financial investment portfolio. Most of REITs are openly traded equity REITs, however there are likewise mREITs or home mortgage REITs that acquire a swimming pool of commercial or domestic home loans, and personal REITs that do not trade on the stock exchanges.

alone, providing all types of investors lots of options. "It's a more varied method of getting genuine exposure than purchasing your house down the street," states Molly Ward, a Financial Advisor at Equitable Advisors. Female financiers simply dipping their toes in REITs may want to think about REIT ETFs. Perfect for those with no specific property investing knowledge, they typically have actually lowered costs and purchase different areas of the market, states Fabbri of Fair Advisors.

Fascination About What Were The Regulatory Consequences Of Bundling Mortgages

" You can get quite particular and have little financial investments in a lot of locations, diversifying within the possession class, which is terrific," states Fabbri. There are currently more than 20 REIT ETFs publicly traded. Another passive method to property investing is purchasing shares in stocks that have a large genuine estate portfolio.

Starbucks and Exxon Mobil, are just two examples of business with large realty holdings. A house is many female's largest possession, but it shouldn't be their only realty financial investment. Great deals of females avoid investing in physical realty, worrying they do not have the cash, understanding, time, or skills to act as a proprietor or remodel a home.

However purchasing an investment property, while challenging, is quickly workable. Sure, you require money upfront, but beyond that, a little knowledge and determination can go a long way. "It's important for ladies to https://www.liveinternet.ru/users/lewartalqx/post477163916/ construct self-confidence in property. It's not brain surgery. It's an incredible quantity of information and a great deal of work, however the advantage is quite enormous," states Quinn Palomino, co-founder, and Principal of Virtua Partners, a worldwide private equity company that invests mainly in single-family property leasings and hotels.

If you're buying realty to generate rental income, your search will vary than if you're searching for a fixer up to turn. Both options will come with their own issues that have to be consisted of in your decision-making process. Take leasing for beginners. Ward of Equitable Advisors states investors anticipating to get a steady flow of monthly earnings need to brace for the unexpected.

Or an expensive repair work could drain pipes all your cost savings. A fix-and-flip comes with its own set of risks, and overpaying for a home is a huge one. As is underestimating the expenses of repairs or need for the house. In any case you go, Palomino states it's best to start small and to gain from your mistakes.

" I have actually seen too numerous people begin a job that was too big, and it swallowed them entire. Typically, financiers in realty will buy a house and repair it up. It's a great method to begin." It doesn't hurt that even regardless of the pandemic, pockets of the domestic property market are seeing fantastic demand.

Everything about How Did Clinton Allow Blacks To Get Mortgages Easier

But with parts of the realty market doing well and diversification important for long term investment success, it's a possession class that certainly should not be overlooked. Own your money, own your life. Register for HerMoney today to get the current money news and tips!.

I have 85 advised tools for you to end up being much better as an investor - what lenders give mortgages after bankruptcy. My very first top priority is assisting you, my reader, to learn and enhance. These tools and resources helped me and I'm enthusiastic they will help you too. Have a look at these tools and resources here: 85+ how to cancel llc Recommended Tools & Resources For Real Estate Investors.

Property can be a great way to invest. Home financial investments have outstanding return capacity and diversify your portfolio to insulate you from recessions and other unfavorable economic conditions. But what's the very best method to buy real estate!.?.!? There's no single right response. You need to take a look at the finest alternatives and choose which will work for you.

Here's a rundown of 9 of the very best ways to invest in realty. what metal is used to pay off mortgages during a reset. The most apparent way to become a genuine estate investor is to purchase a financial investment home (or a number of). When I use the term "financial investment residential or commercial property," I'm referring to a domestic or business residential or commercial property that you prepare to lease to renters-- not a fix-and-flip, which we'll cover later.

The return potential is strong thanks to a combination of income, equity gratitude, and the easy use of take advantage of when buying realty. However, owning rental residential or commercial properties isn't best for everyone, so think about these drawbacks prior to you begin looking: Expense barriers: It can be very pricey to buy your first rental residential or commercial property.